TomoChain (TOMO) is a management token and the underlying asset of a blockchain network based on TomoChain masterbooks, which operate on a modified PoSV proof-of-ownership algorithm.

What is TomoChain

TomoChain is a proof-of-ownership blockchain for creating decentralised applications supported by a masternode network. The blockchain is compatible with the Ethereum virtual machine and has its own Proof-of-Stake Voting (PoSV) consensus with a new reward mechanism that includes some key features:

- low transaction fees,

- faster confirmation times,

- double verification,

- better security,

- lower probability of forks.

It addresses some of the major challenges of modern blockchains, such as scalability, speed, security and fork creation, by focusing on the following key concepts:

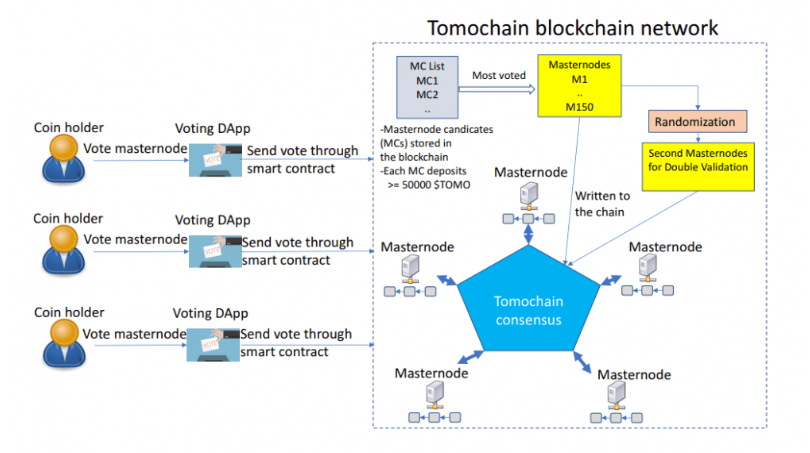

- Double Validation – requires signatures of two masterbooks in a block to send the blockchain.

- Randomisation – one of the masternodes is the creator of the block, while the other, namely the block verifier, is randomly selected from a set of voted masternodes, who verifies the block and signs it.

- Quick verification time – blocks are divided into time slots and epochs: each epoch is divided into 900 blocks of time, which is called the block time slot.

It comes with three key protocols: TomoX to trigger DEX, TomoZ to trigger the token and TomoP, which includes an on-demand privacy layer.

Masternode technology

Blockchain is created and maintained by a network of masterknots through the TomoChain consensus protocol. They store a copy of the blockchain, create blocks and maintain consistency. These are complete nodes containing TOMO and are eligible to become one by having a minimum required number of 50,000 TOMO coins deposited into a smart contract to vote. The next step for a coin holder before they can run the mastercode is to get the most votes in the system from other coin holders via the voting app by submitting TOMO to the smart contract.

In exchange for checking blocks and supporting the network, the masternodes are rewarded with a TOMO coin. The coin holders who voted for these masternodes are also rewarded with a TOMO coin in proportion to the amount of TOMO they have sent in a smart voting contract. Masternode candidates are dynamically sorted based on the number of coins voted, and their performance is tracked and reported to the coin holders. Three metrics are used to determine which masternodes perform best:

- CPU/memory charts – to make sure the node is running at maximum load.

- Number of subscribed blocks – which indicates performance.

- Last subscribed block – from which you can see node activity.

Since coin holders can cancel the vote for a master node at any time due to their poor performance and cast their vote for the best one, this leaves room for competition and ensures that only the most efficient nodes remain to maintain the network. Coin holders are incentivized to do this because they are rewarded if their masternode that they voted for is active and performing the most optimally. There are only 99 seats on the masternode committee, so masternodes must keep up with the competition to stay in the system. Since coin holders vote for them by the number of TOMO coins, their incentive is to continue to perform better than others; otherwise, coin holders interested in investing coins to receive rewards will vote for another, more efficient masternode.

There are three protocols working on top of the blockchain:

Tomo X, a protocol for running decentralized exchanges (DEX) in an efficient and public way to empower diverse DEX, market makers, liquidity providers and independent projects. To register and manage DEX you need a deposit of 25,000 TOMO on the TomoRelayer portal, where you can track, analyze and control all digital assets. This increases the availability of DEX creation, since the process does not depend on technical knowledge and development costs.

TomoZ is a token issuance protocol based on the TRC21 standard, very similar to Ethereum’s ERC20, but with one key difference: you can pay transaction fees in the newly created token instead of your own TOMO blockchain coin. This increases the convenience of issuing and transacting tokens.

TomoP is a privacy protocol designed to create secure and untraceable transactions that allow users to send and receive tokens knowing that the sender and receiver wallet addresses are anonymous. The value transferred between addresses is private. TomoP supports the anonymization of both TOMO token transactions and tokens issued according to TRC21P, the private token standard, including wrapped tokens from other chains (BTC, ETH, USDT, etc.)

Target audience

TomoChain is designed for users who want to make transactions over the Internet in a decentralised and publicly accessible way and have privacy in those transactions when needed. As a platform based on smart contracts, it can act as an enterprise blockchain to create a wide range of decentralised applications and/or issue a unique token.

In addition, the platform targets investors with its staking reward mechanism, in which users can either receive rewards in TOMO coin by maintaining a full masternode, or by voting for a masternode to participate in the maintenance of the network and receive rewards indirectly as they are proportionally distributed to the holders who vote for the masternodes.

Product line

TomoChain has some key differentiators that are available due to its blockchain architecture or some layers of protocol on top of the blockchain. These include fast blockchain time and high transaction throughput, on-demand privacy, low transaction fees, and enhanced security.

Here are some of the products that are originally designed to provide a seamless network:

- Tomo Wallet – which is used not only to store TOMO coins, but also to vote masternotes, track rewards and participate in decentralised applications based on TomoChain.

- TomoMaster – a platform for stacking TOMO with masternotes, tracking rewards and viewing performance statistics on voted masternotes.

- TomoScan – blockchain monitoring and network scanning application, providing full transparency of blocks, transactions, holders, etc.

- TomoDEX – a decentralised exchange based on the TomoX protocol and powered by TomoChain.

- TomoBridge – a chain-to-chain exchange mechanism that allows users to exchange coins between TomoChain and other chains, such as Bitcoin, Etherium, etc.

- TomoRelayer – a platform for registering and managing a decentralised exchange

- TomoIssuer – an intuitive and easy-to-use dashboard for issuing a unique TRC21 token.

- TomoStats – TomoChain network health dashboard where users can check various network health metrics such as masternode performance, TPS, confirmation time, blocking time, etc.

- TomoStatus – System monitoring platform for TomoChain for real-time and historical system performance data

LuaSwap

LuaSwap is a multichain liquidity protocol developed by the TomoChain core team. LuaSwap currently runs on Ethereum. Implementing LuaSwap first on Ethereum makes it easily accessible to a wider audience. It will also run on TomoChain after the planned fourth-quarter hardforward. It aims to help new tokens by providing a liquidity pool for the token in question. In this way, newly issued tokens will have a good chance of obtaining liquidity, as they will not have to compete for market share with the leading token pools. Users will be interested in providing and maintaining a liquidity pool by receiving rewards in LUA tokens.

Prior to the launch of LuaSwap, smart contracts were audited by Arcadia Group, while Quantstamp, PeckShield, Certik and other reputable researchers were invited to participate in the audit process.

Unlike other tokens that are tied to the exchange protocol, LUA, the token is not only used for commissions and transactions, but also serves as a control token in the protocol’s decision-making processes, such as adding additional chain support, the amount of LUA token to obtain liquidity in the new network, which new projects to support and so on.

The AMM-based TomoChain exchange protocol, like its current competitors, has revenue farming features. However, it is designed with an incentive structure to prevent a “start and drop” mentality instead of favouring liquidity pools with ongoing support.

Initially there are only 4 liquidity pools: for the TomoChain token TOMOE – TOMO wrapped Ethereum, to USDC, USDT and ETH, while the newly created LUA token (on TomoChain,) will only be paired to USDC.

Some of the features pending further development include leveraged trading, non-permanent loss reduction and other types of tokens in the pool.

Use cases

As a blockchain-based smart contract platform, TomoChain is mainly used to create decentralized applications. Given some distinctive features, such as a block time of 2 seconds, 2000 TPS, near-zero transaction fees combined with protocol layers, the platform can be used quite effectively to create decentralized financial applications.

Another option is a corporate platform with its “white label” products, namely a wallet, a token issuer and the creation of a decentralized exchange.

With its coin issuing service, TomoChain can help raise funds in any form as an ICO or loyalty program. The economic structure of a custom token can be designed according to the needs and criteria of business goal alignment.

The development of fintech-decentralized applications can be provided by similar layers of the TomoChain protocol, which provide the ability to create customized cryptocurrencies, custom tokens, token placement applications, etc.

Token sales and economics.

TOMO is TomoChain’s own coin that serves as the network’s incentive token to reward masternodes to support the network and facilitate the voting process to validate the consensus voting mechanism according to the stack.

Users can place 50,000 TOMO to create a masternode, but in order for the masternode to participate in the system and sign transactions, other coin holders must vote for them. There are a limited number of seats of only 150 masternodes that can participate in these awards, which serves as an incentive for them to maintain maximum performance. In contrast, coin holders are financially motivated to vote for the most efficient and to override voting for those who can continue to perform in the most optimal way.

Reward Structure.

An epoch consists of 900 blocks, after which a checkpoint block is created, and a total of 250 TOMOs go into circulation for distribution as rewards. For the masternode to receive the reward for checking transactions, it must scan all the created blocks in the epoch and count the number of signatures made. The more blocks signed by a node, the higher the reward will be.

Of the newly introduced 250 TOMO coins, the masternode that participated in the signing gets its share relative to the number of epoch signatures. In each masternode, it is divided into three parts:

- Infrastructure Contribution Reward (40%): supported by the Masterkind.

- Stakeholder Reward (50%): distributed proportionally to all coin holders who voted for a particular Masternode, depending on how many coins they put up.

- Foundation Reward (10%): paid into a special account controlled by the Masternode Foundation, which is initially managed by TomoChain.

According to the staking portion of the reward, coin holders who do not vote for a specific mastercode before the checkpoint block is created will not receive their reward in a TOMO coin.

Token distribution and issuance period

A total of 100 million TOMO tokens have been created and will be issued into circulation. There were 55 million TOMO coins in circulation in the genesis block. In addition, 12 million were reserved for the team, which was distributed linearly over 4 years, and 16 million were reserved for strategic partnerships and ecosystem building. Another 17 million were reserved for blockchain rewards.

From the mainet launch, the reward per block for the first two years is 4 million TOMO coins per year, after which the supply is halved to 2 million TOMO coins per year in the next three years. The block reward for years 6, 7 and 8 will again be halved to 1 million TOMO per year.